Largest U.S. Pension Buys AMC and GameStop stock

One of the largest pension funds in the United States just purchased AMC and GameStop stock.

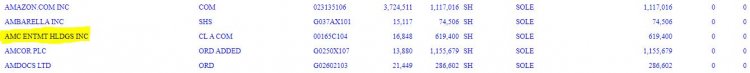

The California Public Employees' Retirement System (CalPERS) more than quadrupled its investments in AMC Entertainment Holdings (AMC) and GameStop (GME) and increased its holdings in Berkshire Hathaway, Buffett's investment company. CalPERS also sold nearly 11% of its stake in Palantir Technologies, a provider of data-analytics software.

According to a form filed with the Securities and Exchange Commission, the pension disclosed the trades among others. In the U.S., it manages more assets than any other public pension fund with $480 billion.

According to Sec form 13F Calpers purchased 1.7 million more shares of Berkshire Hathaway, giving it 5.6 million shares at the end of the fourth quarter.

CalPERS sold 382,239 shares of Palantir, leaving it with 3.2 million shares.

In the fourth quarter, the pension purchased 503,000 more shares of AMC, bringing its stake to 619,400 shares.

AMC Entertainment preannounced a strong fourth quarter and reduced debt in January, from its near-bankruptcy in early 2021, AMC Entertainment has made a lot of progress.

CalPERS increases its GameStop stock shares

Calpers purchased another 70,600 shares of Video Game retailer GameStop to end the quarter with 85,400 shares.

A partnership between GameStop and Immutable X was recently announced for its NFT marketplace, the company is also exploring cryptocurrency partnerships.

AMC Entertainment has also experimented with the NFT world. The company released its first-ever Spider-Man NFT and embraced the new technology.

Related: NFTs for beginners

Meme stocks fundamentals

GameStop and AMC both have debts but are innovating to reduce them.

Adam Aron, CEO of AMC Entertainment announced that the company was refinancing its debt in order to lower interest rates.

To finance debt due by 2025, the company also sold a $950 million junk bond this year.

Currently, AMC has a short interest of 21%, while GameStop has a short interest of 17%.

AMC hit 72$ last year with a short interest of 20%.

Let us know what you think in the comments or leave a reaction using the Emojis

What's Your Reaction?