How Current Borrow Fees for AMC Stock Could Spark a Significant Short Squeeze

Due to high demand from short sellers, the borrow fees for AMC shares have surged to triple-digit percentages. Here's what you should know.

|

Short sellers looking to take a bearish position on a specific stock must first obtain a loan of that stock from a broker. However, a high borrow rate is indicative of strong demand to short sell that stock. This increased demand creates competition among short sellers, leading to a rise in the cost of borrowing the shares, and consequently lowering the profitability of the short trade.

As the borrow rate increases, shorting the stock becomes more expensive, thereby reducing the potential gains from the trade.

Related article: The Dangers of Short Selling: Understanding High Borrow Rates in Stocks

The fees for borrowing shares are levied by brokers daily and are subject to the laws of supply and demand. A surge in the interest of short sellers in betting on a stock result in a decrease in the number of shares that are available for borrowing, which in turn increases the cost of borrowing those shares.

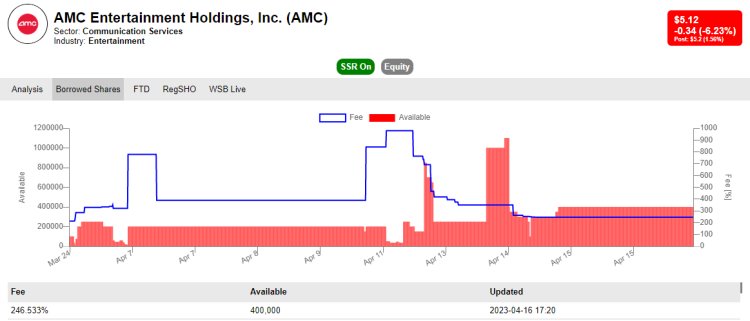

AMC's borrowed shares. Stocks.investorTurf.com, data from Interactive Brokers

When delving into AMC's situation, there are multiple factors at play.

One such factor is the significant number of arbitrage trades that aim to exploit the difference in value between AMC Preferred Equity (APE) units and AMC stock.

This activity has contributed to the overall situation, and it's not the only force at work. There are other variables that have influenced the situation, and they too deserve attention.

However, the high volume of arbitrage trades is a critical piece of the puzzle that cannot be ignored. Its impact is noteworthy, and its effects ripple throughout the system.

As AMC's borrow fees reach stratospheric levels, it is a sign that there are fewer and fewer shares available for borrowing. In recent trading sessions, there were several times when there were zero shares available.

Institutional investors have been indisputably curtailed in their ability to make substantial short-selling trades in AMC.

Why AMC Will Face More Volatility

AMC finds itself at a critical juncture as it prepares to navigate significant changes soon. These developments include the recent authorization of APE unit transformation into AMC common shares, as well as a reverse stock split.

While these events could have bearish implications, the conversion of APE units into AMC common shares may have dilutive effects on the stock's float, which could be contributing to the short sellers' considerable bets.

However, AMC intends to employ the APE conversion as a means of raising capital, which would allow it to write down or renegotiate debt for equity at a significant discount. This would ultimately be advantageous for both AMC and its shareholders in the long run.

Although the reverse stock split could enhance the strength of AMC's stock price, it may have an impact on its volatility in the short term. Even though shareholders voted on the two proposals, the company must still confront a class action lawsuit in Delaware Chancery Court aimed at delaying the conversion.

Is a squeeze possible?

AMC shares are currently on the brink of a short squeeze due to various factors. One of these is the high short interest, which stands at approximately 26% of its float. Moreover, thanks to its strong performance earlier this year, short sellers have suffered losses exceeding $230 million year to date.

Additionally, borrow fees for AMC are in the triple digits, and the stock has been highly unstable in recent months.

Whenever a stock is costly to borrow, some short sellers may find themselves compelled to close their positions, taking any profits they have left, before other buy-to-cover orders trigger an upward surge in the stock.

This could potentially result in unlimited losses. For a short squeeze to occur, there needs to be a substantial buying volume. In AMC's case, a lot has been happening since the shareholder vote, and traders are closely monitoring the stock, waiting for a reason to hit the buy button.

| Disclaimer: InvestmentTurf is not an investment advisory, and its content should not be used in making investment decisions. The information provided by this website authors should only be used for informational purposes. There is no liability on the part of InvestmentTurf or its authors for any direct or consequential loss resulting from using the information found on the website. Readers are responsible for their own investment research and decisions. There should be no construing of information found on the website as advice tailored to individual investor needs, nor should it be used as the sole basis for investment decisions.

The users on this website are neither registered securities broker-dealers nor investment advisers. The author could be long one or more stocks mentioned in this report. |

What's Your Reaction?